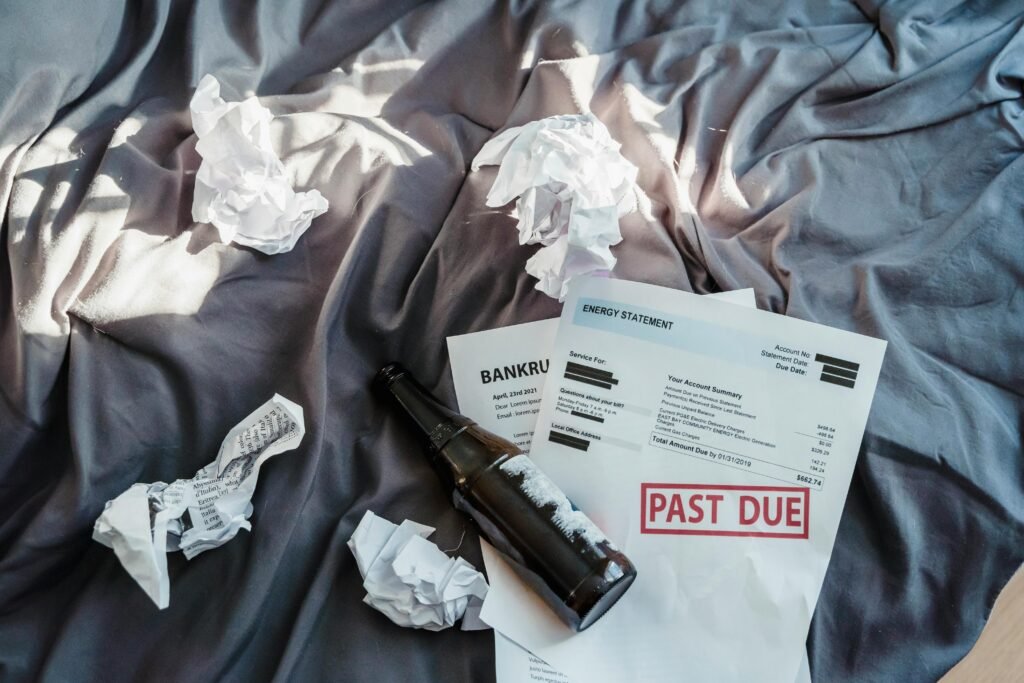

If you’re looking for how to get out of debt but feel like you don’t have the extra cash to pay off your bills, you’re not alone. Many people find themselves overwhelmed by debt, whether it’s from credit cards, loans, or other financial burdens. The good news is that getting out of debt is absolutely possible—even if you’re starting with no money. You don’t need to be rich or have a huge income to begin your journey toward becoming debt-free. It just requires consistent, small actions that help you chip away at your debt over time.

How to get out of debt can feel overwhelming, but when broken down into easy, manageable steps, it becomes much more achievable. Whether you’re trying to pay off credit card debtThe amount of money a person owes to a credit card company d... More, student loans, or any other type of debt, this guide will show you how to get out of debt even if you don’t have money to start. Each tip in this article will help you reduce your financial stress and take control of your money, putting you on the path to financial freedom.

1. Make a List of All Your Debts

Before you start paying off your debts, take a moment to figure out exactly what you owe and to whom. This will give you a clearer idea of how to get out of debt, helping you create a plan and prioritize your next steps.

How to Make Your List:

- Write down all the people or companies you owe money to (like credit cards, loans, and medical bills).

- Sort them by either the amount you owe or by which ones have the highest interest rate.

This will give you a better idea of which debts to tackle first. Focus on one at a time, and you’ll slowly start chipping away at your total debt.

2. Cut Out Unnecessary Spending

One of the best ways to free up money to pay off debt is by cutting back on unnecessary spending. This may not be the most fun approach, but it will make a significant difference in your quest for how to get out of debt.

Tips for Cutting Back:

- Cancel subscriptions you no longer use (like streaming services or gym memberships).

- Cook meals at home instead of eating out.

- Opt for free or low-cost activities with friends instead of spending money on entertainment.

These small adjustments can save you a surprising amount of money that can be redirected toward getting out of debt.

3. Talk to Your Creditors

If you’re struggling to make your payments, don’t be afraid to reach out to your creditorsCreditors are individuals, companies, or institutions that a... More. They want you to pay, but they also want to work with you. Communicating your situation can be a big step in learning how to get out of debt and avoid financial hardship.

How to Ask for Help:

- Call the creditorsCreditors are individuals, companies, or institutions that a... More you owe money to and explain your situation honestly.

- Request a lower interest rate or an extended repayment plan.

CreditorsCreditors are individuals, companies, or institutions that a... More are often willing to help if they see you’re genuinely trying to make progress.

4. Get a Side Job or Gig

If paying down debt seems impossible with your current income, consider taking on a side job or gig to boost your cash flow. This will help you discover how to get out of debt while improving your financial situation.

Easy Gigs to Try:

- Drive for Uber or Lyft.

- Deliver food for DoorDash or UberEats.

- Sell unused items around your home, like clothing, electronics, or furniture.

Even small extra earnings can quickly add up and go a long way toward paying off your debt.

5. Consider Debt Management Help

A Debt Management Plan (DMP) is another viable option when looking for how to get out of debt. Through a DMP, a credit counseling agency works with your creditorsCreditors are individuals, companies, or institutions that a... More to lower your interest rates and help organize your debts so you can pay them off more effectively.

Benefits of a DMP:

- You make one simple monthly payment.

- Interest rates may be reduced, saving you money over time.

If you’re feeling overwhelmed by your debt, a DMP may provide the structure and guidance you need to achieve how to get out of debt faster.

6. Sell Unused Items

Another smart way to generate quick cash for your debt is by selling unused items around your home. By selling things you no longer need, you free up space and get extra money to pay off your bills, helping you move closer to how to get out of debt.

What to Sell:

- Clothes in good condition

- Electronics like phones, laptops, or gadgets

- Furniture or household appliances you don’t use

You’ll be amazed at how much money you can make, and that cash can go directly toward reducing your debt.

7. Consolidate Your Debt

Debt consolidation is an excellent strategy if you’re looking for how to get out of debt in a simpler, more manageable way. By consolidating your debts, you combine multiple payments into one, which might help you save on interest and streamline your debt repayment plan.

Ways to Consolidate:

- Get a personal loan with a lower interest rate than your current debts.

- Use a 0% interest credit card to transfer high-interest balances.

Debt consolidation can ease your financial burden by simplifying your payments and lowering interest rates, making it easier to get out of debt over time.